Housing Market Crash??? Bitcoin price prediction!

The Biggest opportunity for the next 3-5 years!

👋 Hello Everyone.

Some great news. So many of you have asked for a course on the various topics we dive into through my private community and the public lives that I do. With that said Austin and I have put together an amazing and affordable course that is live now (Lin in my Stan Store). The course is called: The Rich Habits Podcast - Wealth Building Blueprint. I am so excited about this course and feel it is a great first course for us and all of you.

The course is priced at $45 dollars and is based on $1 dollar per minute. I felt that this was a great way to provide additional value while still making it affordable for all. I will be updating in the days to come and you will be able to find it in various links in bio and other locations. Thank you all so much for following along on this journey and loving the content and insight that I provide daily, weekly and monthly.

📣 Is the housing market going to CRASH??

That is the billion dollar question and I don’t see it happening!!!!!!

With the US housing market coming out of 2 years of the lowest rates in history, the numbers just don’t add up. Right now 25% of mortgages are below 3% and 65% are below 4% and 40% of all homes currently have no mortgage. So because of that the likelihood of distress in the housing market is very low and you must have distressed sellers to see a real estate crash. so that leaves the question is it a good time to buy???? Rates are obviously high but you can always refinance. So in my opinion - Buy what you can afford and stop trying to time the market.

Keep in mind these 5 key takeaways:

Housing prices have increased 5 months in a row (a 1.9% year over years increase just in July).

Inventory remains very low. This point alone will prevent from a pricing crash. There is just too much competition for what inventory is available.

Builders are not building enough to meet demand. This is key throughout most markets that builders simply couldn’t catch up to demand even if they wanted to.

Post pandemic and with more people working from home - there is a need for more space for many would be buyers.

Foreclosure numbers are almost non-existent. With so many people enjoying low rates and now decent equity in their homes there is not the huge numbers of foreclosures like the 2009 crash.

With all of that said. In my opinion the best time to buy real estate was yesterday.

Subscribed

🎙️ I am also really excited about how quickly the podcast has grown. So thank all of you that have downloaded and given it a listen. We have climbed the charts very rapidly and we are currently ranked #5…For those of you that have not stopped by it is the Rich Habits podcast on Spotify and Apple. And please feel free to DM me or message on any platforms and let me know your thoughts and takeaways.

For all PAID community members please note that the private livestream is now being held on ZOOM and its awesome. It is scheduled every Thursday @ 7pm EST. This is so exciting and will add so much more personal/community interaction. So buckle up and let’s have some fun.

💸 Is the S&P 500 going to continue to fall? Whats next in the coming months.

The S&P 500 dropped down 1.4% in the month of August bringing the year to date gains down to 18.8%. Investors were discouraged by commentary by Federal Reserve Chair Jerome Powell at the Jackson Hole Economic Symposium suggesting more monetary policy tightening may be coming.

Inflation, interest rates and the labor market will likely continue to dominate Wall Street headlines in September. So keep a close eye as the bumpiness will provide solid buying opportunities.

In his annual speech at Jackson Hole in August, Powell said inflation is still “too high” and warned investors that “we are prepared to raise rates further.” Powell also said the combination of decelerating inflation and a solid economy will allow the Fed to “proceed carefully” at future meetings.

In my opinion it’s business as usual. Even with the recent downturn we are still up nicely for the year and we will continue to find the opportunities through diversity and tenacity!!!!!

😭😭 What is a dividend paying stock and what are my 3 favorites to watch right now?

A dividend-paying stock is a type of stock issued by a publicly-traded company that distributes a portion of its earnings to its shareholders in the form of dividends. Dividends are typically paid on a regular basis, often quarterly, and represent a share of the company's profits. The key takeaway here is that you get paid 2 ways: the dividends (regular income) regardless of the stock price and capital appreciation when the stock price increase.

Watch list: 1) Clearwater Energy (CWEN) 6.26%, Crown Castle (CC) 5.4%, Verizon (VZ) 7.6%.

🤔 What is a succession plan???? And why is the lack of education on the topic so important for all of you?

A succession plan is a strategic and structured process that outlines how a business owner will transition the ownership and management of a company to new leaders or owners when key individuals, often the aging business owner, retire, resign, or pass away. Succession planning is essential for ensuring the continuity and long-term success of a business. Here are the top 5 takeaways for aging business owners considering a succession plan:

Start Early: Succession planning should ideally begin years in advance of when it's needed. Starting early allows for careful consideration of potential successors, thorough training, and the development of a well-thought-out plan. Waiting until a crisis or unexpected event occurs can lead to rushed decisions and negatively impact the business.

Identify and Develop Potential Successors: Identify individuals within the organization or family who have the potential to take over leadership roles. This could be a family member, a key employee, or an external candidate. Invest in their development through training, mentoring, and leadership development programs to prepare them for their future roles.

Financial Planning: Assess the financial aspects of the transition. Determine the value of the business, understand tax implications, and explore funding options. This may involve selling the business, transferring ownership to family members, or structuring a buyout with key employees. Financial planning is crucial to ensure a smooth transition without causing financial strain on the business or the owner.

Communication and Documentation: Open and transparent communication with all stakeholders is essential. Discuss the succession plan with family members, key employees, and other relevant parties. Document the plan in detail, including roles, responsibilities, timelines, and contingencies. Having a clear roadmap helps avoid misunderstandings and conflicts down the line.

Seek Professional Guidance: Succession planning can be complex, involving legal, financial, and tax considerations. It's advisable to seek professional advice from attorneys, accountants, financial advisors, and business consultants who specialize in succession planning. They can help navigate legal requirements, tax implications, and ensure the plan is well-executed.

Additionally, it's important for aging business owners to consider their personal retirement and estate planning alongside the business succession plan. This includes reviewing personal finances, estate documents, and considering how the proceeds from the business transition will support their retirement lifestyle and provide for their heirs.

So where is the opportunity here???? Thats simple - endless baby boomers are retiring without succession plans in place and their kids do not want their brick and mortar businesses. This is where you come in!! There has never been a better time to buy aging businesses that are still viable and many times profitable. Many times you can buy these businesses with owner financing and implement modern marketing and sales tactics and really grow these companies into cash making machines.

I love www.bizbuysell.com and loopnet.com to start. But you can also drive for dollars and find some real opportunities.

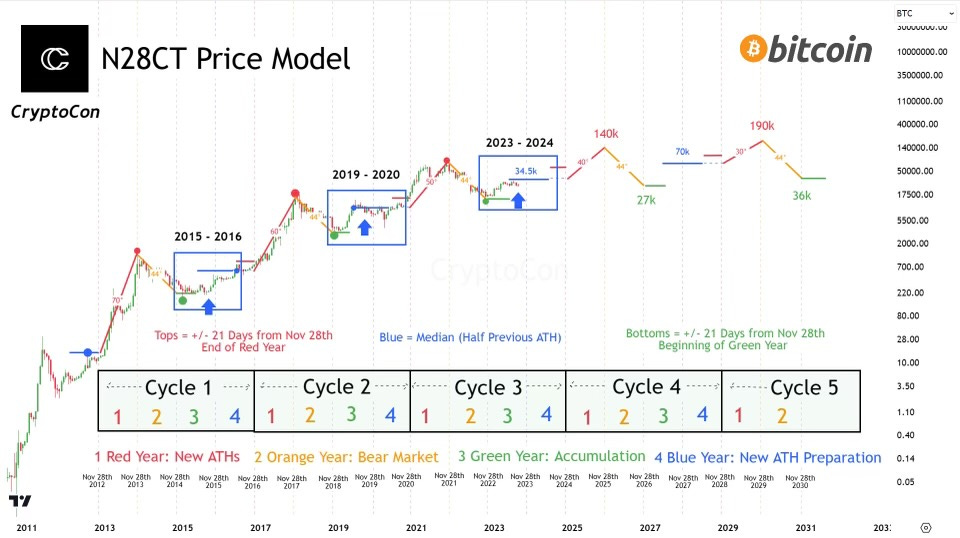

👂👂 Have you been following the BITCOIN news? Take a look at this chart and the price predictions for the coming years.

As I have stated for years. I believe everyone should have a portion of their net investable capital in Bitcoin and other high value crypto currencies. I would say based on price predictions and adoption the average price of 1 Bitcoin in 3 years should range between $125k-175k. Others like Cathie Woods and Michael Saylor predict a much higher range. SO keep your eye on the prize and always be DCAing (dollar cost averaging) your way to some great returns.

Weekly Book Excerpt (“To many people spend money they haven’t earned, to buy things they don’t want, to impress people that they don’t like'“) - Will Rogers

I love this quote. It is so eloquently stated and on point. This really hits hard as it relates to modern times and the comparison based lifestyles that we lead today. It really illustrates that lifestyle creep and keeping up with the Joneses creates a real problem for many Americans when trying to become financially free.

Money Mindset - Weekly insights

Have you tried Acorns yet. I know you all have heard me talk about this awesome platform for years but now I am officially working with them and I couldn’t be more excited. If you haven’t used Acorns yet its a must in your wealth building journey. Even if you use it just for the roundup feature.

How it works - You simply attach your bank account and set the rate of risk you want in your portfolio and Acorns does the rest by rounding up your daily purchases and investing those funds. It’s such a great investment tool because it is automated and just a few cents at a time. It’s like found money.

Brand of the month - Public.com

As you all know I love Public.com and all they have to offer. If you haven’t signed up yet, I suggest you go check it out. I use Public mostly for purchasing Treasury Bills and Cryptocurrency but they offer so many great features. So when you are ready to sign up go to my Instagram - @robertcroak and use the link in bio. Enter richhabits as the code for some FREE stock and get busy diversifying your portfolio.

Thanks for following along. See you soon!