Crypto is ripping but will it last? IRS adjusts deductions for 2024

10 year yields continue to rise. HSBC plans digital assets custody

🚀Dear Valued Subscribers,

Welcome to another exciting week filled with compelling topics and investment insights. In this newsletter, we're delving into key areas that have been making waves in various markets. Here's a sneak peek into the topics we'll be exploring:

HSBC Plans Digital-Assets Custody Service With Metaco

7 Tips For Understanding Upside Potential In A Deal

10-Year Yields Continue To Rise: Considerations + Planning

IRS Adjusts Incoming Tax Brackets And Deductions For 2024

Crypto Market Update: Will Bitcoin Continue Up?

So folks, strap in as we have a lot to cover as we dive into the materials for this week's newsletter!

HSBC Plans Digital-Assets Custody Service With Metaco

HSBC, one of the world's largest banks, is set to launch a digital-assets custody service in collaboration with Swiss crypto safekeeping specialist Metaco. The service, slated for 2024, will focus on securing tokenized securities for institutional clients. This move aligns with the broader industry trend of banks exploring blockchain for tokenizing real-world assets.

HSBC's custody plans will complement its existing digital asset platforms, forming a comprehensive solution for managing various digital assets. The collaboration with Metaco, acquired by Ripple in May, signifies a strategic push towards secure digital asset storage, showcasing HSBC's commitment to innovation in the evolving landscape of digital assets.

Key Takeaways

Mainstream Adoption of Tokenization: HSBC's move to launch a digital-assets custody service for tokenized securities reflects a growing trend in the financial industry towards embracing blockchain technology for mainstream adoption. As a major global bank, HSBC's entry into this space could signal increased acceptance of tokenized assets as a legitimate and secure form of investment.

Integration of Traditional Banking with Crypto Services: The collaboration with Metaco and the focus on digital asset custody demonstrates a shift in traditional banking towards integrating cryptocurrency and blockchain services. By providing a secure custody solution for digital assets, HSBC is positioning itself to cater to institutional clients seeking exposure to the tokenized securities market.

Ripple's Influence in the Crypto Landscape: The acquisition of Metaco by Ripple for $250 million highlights the influence of major players in the cryptocurrency space. Ripple's involvement in the development of a robust digital asset custody platform adds a layer of credibility to the project. This partnership could potentially influence how other financial institutions view collaborations with cryptocurrency-related entities, paving the way for increased collaboration between traditional banks and crypto-focused companies.

7 Tips For Understanding Upside Potential In A Deal

Evaluating the upside potential in a deal involves a thorough analysis of various factors. Here are some key considerations to help you understand and gauge the upside potential:

Market Analysis:

Market Trends: Study current and future trends in the relevant market. Understand the demand-supply dynamics, emerging technologies, and shifts in consumer behavior.

Competitor Analysis: Analyze the competitive landscape to identify market leaders, potential disruptors, and your position in the market.

Financial Metrics:

Return on Investment (ROI): Calculate the potential return on investment by assessing the projected profitability against the initial investment. Consider factors like net present value (NPV) and internal rate of return (IRR).

Profit Margins: Evaluate the gross and net profit margins to understand the profitability of the deal.

Business Model and Strategy:

Business Plan: Review the business plan thoroughly. Understand the revenue streams, cost structures, and scalability of the business model.

Growth Strategy: Assess the company's growth strategy. Look for well-defined plans to capture new markets, expand product lines, or enhance operational efficiency.

Operational Considerations:

Efficiency Measures: Evaluate the efficiency of operations. Assess factors such as production efficiency, supply chain effectiveness, and overall operational excellence.

Scalability: Consider whether the business can scale its operations effectively with increasing demand.

Risk Assessment:

Identify Risks: Understand the potential risks associated with the deal, both internal and external. Assess the impact of these risks on the upside potential.

Risk Mitigation Strategies: Look for strategies outlined in the deal to mitigate identified risks. This demonstrates foresight and planning by the involved parties.

Market Positioning:

Unique Value Proposition: Assess the uniqueness of the product or service. A strong and unique value proposition can contribute significantly to the upside potential.

Customer Base: Understand the characteristics of the customer base, including its size, demographics, and loyalty.

Exit Strategy:

Clear Exit Plan: Understand the exit strategy outlined in the deal. A well-defined exit plan provides clarity on how investors can realize returns.

Remember that assessing upside potential is a dynamic process, and staying informed about market changes and adapting your analysis accordingly is crucial. Conducting thorough due diligence and seeking expert advice when needed can enhance your understanding of the deal's upside potential.

10-Year Yields Continue To Rise: What Effect Do Rising Bond Yields Have On The U.S Economy?

When the yield on the U.S. 10-year Treasury bond rises, it can have several implications for investors and the economy. Here are 5 KEY ways in which rising bond yields historically have affected the the economy:

Impact on Bond Prices:

Inverse Relationship: As you mentioned, there is an inverse relationship between bond yields and bond prices. When yields rise, bond prices generally fall. This means existing bondholders may see the value of their bonds decrease.

Effect on Interest Rates:

Benchmark for Interest Rates: The 10-year Treasury yield serves as a benchmark for various interest rates in the economy. When it rises, it can influence other interest rates, including those for mortgages and corporate loans. Higher interest rates can lead to increased borrowing costs for individuals and businesses.

Inflation Expectations:

Inflation Hedge: Bond yields can reflect inflation expectations. When yields rise, it may signal expectations of higher inflation. Investors may adjust their portfolios to hedge against the eroding effects of inflation, potentially favoring assets like commodities.

Impact on Mortgage Rates:

Mortgage Costs: Mortgage rates are closely tied to Treasury yields. As the 10-year Treasury yield rises, mortgage rates may also increase. Higher mortgage rates can affect the housing market by making home financing more expensive for potential buyers.

Market Volatility:

Increased Volatility: Rapid movements in bond yields can contribute to increased volatility in financial markets. Investors may reevaluate their risk exposures, leading to fluctuations in asset prices.

Thus, the rise in the U.S. 10-year Treasury bond yield can signal significant shifts in investor sentiment, expectations about economic conditions, and impact various financial markets. Therefore it’s important that each of us carefully monitor these developments moving forward, and adjust our investment strategies accordingly to navigate changing market dynamics.

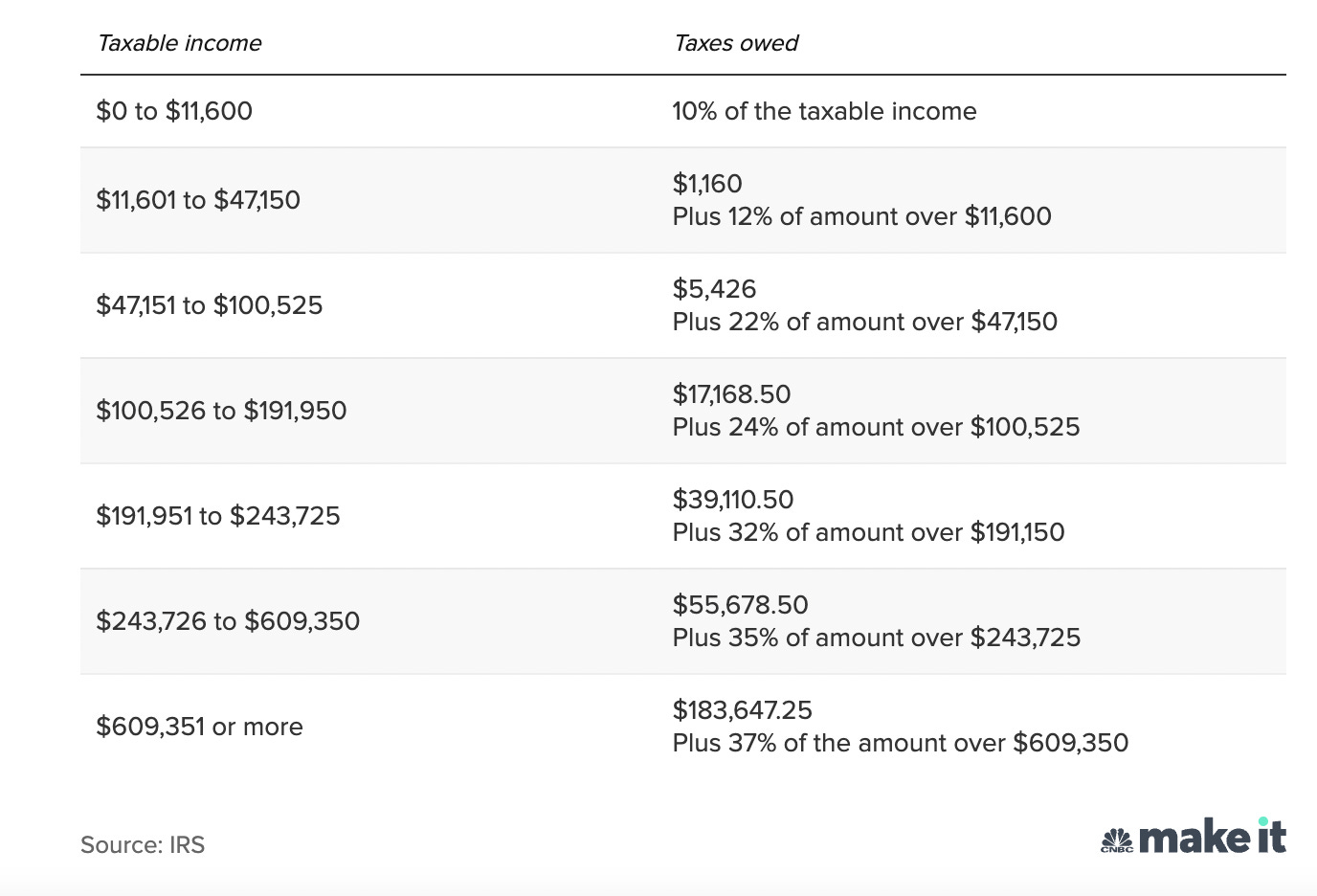

IRS Adjusts Income Tax Brackets and Deductions for 2024

The Internal Revenue Service (IRS) has announced adjustments to income tax brackets and standard deductions for the upcoming year. These changes, influenced by rising inflation, mean that taxpayers will need to earn more to fall into higher income brackets with increased tax rates in 2024. For instance, the top tax rate of 37% will now apply to individuals making more than $609,350 and jointly filing married couples earning over $731,200. This reflects an increase from the 2023 thresholds of $578,125 and $693,750.

Additionally, the standard deduction, a fixed amount reducing taxable income for those who don't itemize, is set to rise. Single filers will see their deduction increase to $14,600 in 2024 from $13,850 in 2023, and for married couples filing jointly, it will go up from $27,700 to $29,200. These adjustments aim to accommodate inflationary trends, impacting how taxpayers navigate the upcoming tax season in 2024. Stay informed for a smoother financial journey next year!

Who Does This Benefit The Most?

The adjustments to income tax brackets and standard deductions announced by the IRS for 2024 can have varying impacts on different groups, but certain individuals may benefit more:

High Earners: The shift in income tax brackets, particularly the increase in the top tax rate threshold, benefits high earners. Individuals with taxable income above $609,350 and married couples filing jointly earning over $731,200 will experience a higher threshold before reaching the top tax rate of 37%.

Standard Deduction Users: Those who opt for the standard deduction rather than itemizing may benefit from the increased standard deduction. This includes individuals who find that the standard deduction exceeds the total value of their itemized deductions.

Married Couples: The boost in the standard deduction for married couples filing jointly from $27,700 to $29,200 provides additional relief. This increase allows them to reduce their taxable income by a larger fixed amount.

Crypto Bulls Continue To Rejoice As Bitcoin Hits $38,000 and Altcoins Soar!

Bitcoin: Last week when writing, Bitcoin had soared to $38,000, and one week later it remains strong. Upon hitting $38,000 last week, Bitcoin had a quick flush back down to $34,700. While many speculated that it was going to continue to crash, Bitcoin quickly rebounded and has since re-tested $38,000. While it's unclear if Bitcoin will continue higher before experiencing a deeper correction, its initial rebound does speak to its strength, at least in the short term. We must remember that Bitcoin has climbed over 40% in the last 30 days, so I wouldn’t be surprised to see a correction in the not so distant future.

This Bitcoin Technical Urges Short Term Caution:

The ‘Relative Strength Index (RSI)’ is an indicator the technical traders use to gauge the overall strength of a stock or a crypto asset. It confirms established trends, and points out divergences in price. The chart below shows Bitcoin’s current (daily timeframe) RSI…

Without getting too technical, you can see that Bitcoin has formed a clear uptrend on the RSI since the beginning of this trend (September). While it hasn’t broken this trend yet, it is getting close, and since it's towards the top of the range, a break of this line is becoming more and more imminent. Historically, when major RSI trends are broken, that leads to a correction, or in some cases a larger directional shift in the market. We will continue to monitor this indicator!

Altcoins

At this point, it seems as if altcoins will follow what Bitcoin does, at least in the immediate short-term. If Bitcoin breaks the trend that was analyzed above which would likely lead to a crash, there is a VERY high chance that Altcoins will be dragged down with BTC. This is nothing to be devastated about, though, as Altcoins have had an incredible run and are probably due for a healthy pullback anyway. Let’s see how some of our favorite altcoins have performed in the last 30 days (from the beginning to its peak height):

Solana (SOL): 217%

Chainlink (LINK): 129%

Polygon (MATIC): 93%

Cardano (ADA): 67%

Ripple (XRP): 54%

Thus, while we may not want to hear that our beloved Alt’s may be in line for a pullback, we must acknowledge that this type of price movement is healthy (and normal) in markets that have climbed as substantially as altcoins have.

Have all of you checked in on your Bitrock holdings? Wow what a great ride so far! Always make sure to dollar cost average into all of your favorite investment plays and be consistent. And when they pop always consider taking some profits!

Weekly Book Quote:

“A part of all you earn is yours to keep. It should be not less than a tenth no matter how little you earn”. Book: the Richest Man in Babylon - George Samuel Clason

Takeaway: Written nearly 100 years ago and still remains factual. To create financial freedom and retire comfortably it starts with saving and investing a minimum of 10% of your earnings. So create that budget, be consistent and you will have the security you desire when retirement is approaching.